Why So Many Americans Are Turning to Index Funds

If you’ve ever felt overwhelmed by the idea of investing, you’re not alone. Between stock charts, financial jargon, and daily market noise, it can feel like only experts belong in the investing world. But here’s the truth: you don’t need to be a Wall Street pro to grow your wealth. That’s exactly why millions of Americans have turned to index funds — an easy, reliable, and proven way to invest for the long run.

Index funds are simple to understand, low in cost, and backed by some of the most respected investors in history, including Warren Buffett. In fact, Buffett himself famously said that most people would do best by just buying an S&P 500 index fund and holding it for life. So, what makes index funds such a strong choice, especially for beginners in the U.S.? Let’s break it down step by step.

What Is an Index Fund?

An index fund is a type of investment that automatically tracks a specific market index — like the S&P 500, NASDAQ 100, or Dow Jones Industrial Average. Instead of trying to pick individual stocks that might win or lose, an index fund simply mirrors the performance of the entire index.

Think of it as owning a small piece of hundreds of top companies in one go. When the index rises, so does your investment. When it dips, your investment does too. But over time, the overall trend of the U.S. stock market has historically gone upward, rewarding long-term investors.

Why Index Funds Are Perfect for Beginners

There are several reasons why index funds are ideal for people just starting their investment journey in the U.S.:

- Diversification Made Easy – Instead of buying one company’s stock, you own shares in dozens or even hundreds. That reduces risk because your investment isn’t tied to just one company’s performance.

- Low Fees – Index funds are passively managed, meaning there’s no team of analysts making constant trades. That keeps management costs low, leaving more of your money to grow.

- Consistent Performance – Historically, index funds have outperformed most actively managed funds over time. They follow the market’s natural growth rather than trying to beat it.

- Long-Term Simplicity – You don’t need to monitor charts daily. Once you invest, you can let compounding and time do the heavy lifting.

How Index Funds Work: The Simple Mechanics

Imagine the S&P 500 index fund. It includes 500 of the largest publicly traded companies in the U.S. like Apple, Amazon, Microsoft, and Google. When you invest in an S&P 500 index fund, your money is automatically divided among all those companies based on their market value. If Apple’s stock grows, your investment benefits in proportion to Apple’s weight in the index.

Every time the companies in the index change (which happens periodically), your fund automatically adjusts — without you lifting a finger.

Types of Index Funds to Know

There are different types of index funds you can invest in, depending on your goals:

- Stock Index Funds – Track stock market indexes such as S&P 500, Nasdaq 100, or Total Market Index.

- Bond Index Funds – Track U.S. government or corporate bond markets, ideal for more stable returns.

- International Index Funds – Give you exposure to global markets outside the U.S., balancing risk and growth potential.

- Sector Index Funds – Focus on specific industries like tech, healthcare, or energy.

If you’re a beginner, a broad-based stock index fund like the Vanguard Total Stock Market Index Fund (VTSAX) or Fidelity 500 Index Fund (FXAIX) is often a smart starting point.

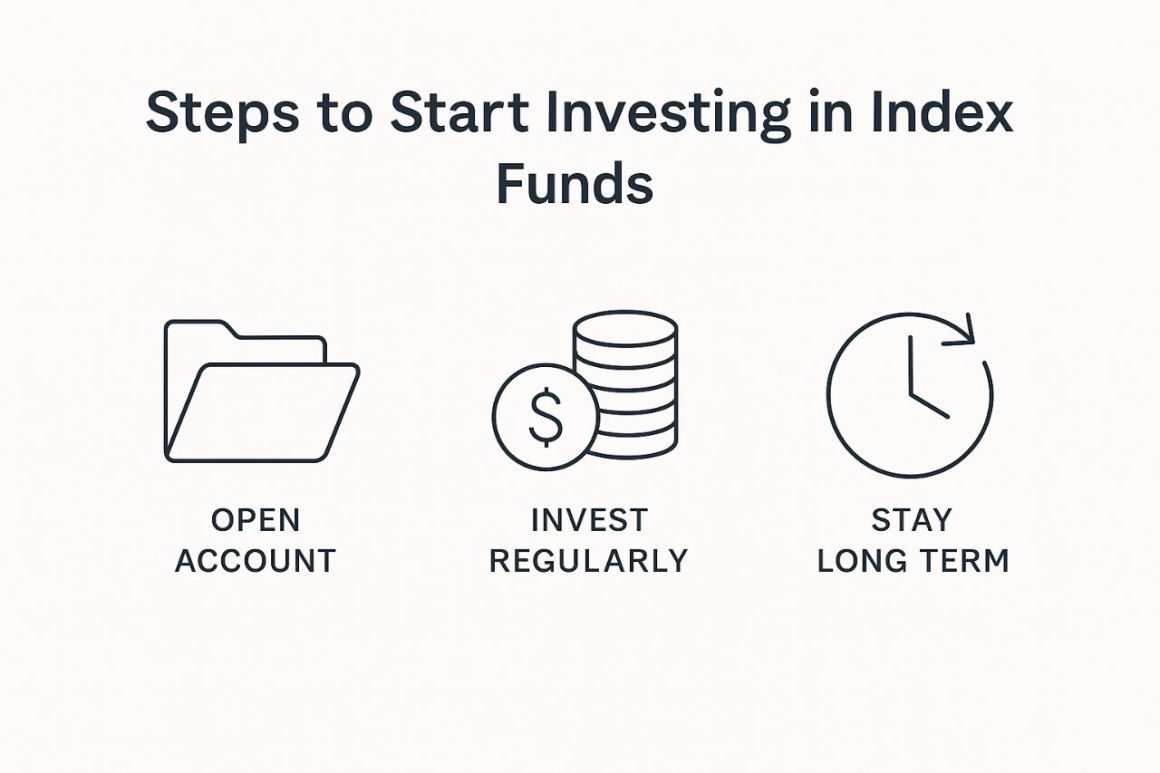

How to Start Investing in Index Funds in the U.S.

Here’s a simple roadmap for beginners:

-

Choose a Brokerage Account

Open an account with a trusted U.S. broker like Vanguard, Fidelity, Charles Schwab, or Robinhood. -

Select Your Index Fund

Pick a well-diversified fund. For example:- Vanguard S&P 500 ETF (VOO)

- Schwab Total Stock Market Index Fund (SWTSX)

- Fidelity ZERO Total Market Index Fund (FZROX)

-

Decide How Much to Invest

Start small — even $50 to $100 a month can grow over time. Use dollar-cost averaging — investing a fixed amount regularly — to smooth out market ups and downs. -

Set It and Forget It

Index fund investing rewards patience. Avoid checking prices daily. Stay invested through market cycles and let compound growth work for you.

The Power of Compounding in Index Fund Investing

Here’s the magic part: compounding. When your investments earn returns, and those returns start earning returns, your wealth grows exponentially. For instance:

If you invest $200 per month in an index fund earning an average of 8% annually, after 20 years, you’d have over $118,000 — even though you only invested $48,000. That’s the power of staying consistent and letting time do its job.

Common Myths About Index Funds (and the Truth)

Myth 1: You need a lot of money to start.

Truth: Many brokers allow you to start with as little as $10 or $50.

Myth 2: Index funds are boring.

Truth: They may not be flashy, but their steady growth beats most active strategies over time.

Myth 3: You’ll miss out on big gains from hot stocks.

Truth: Index funds already include many top-performing companies — you own pieces of them automatically.

Risk and Reward: What to Expect

No investment is 100% safe. Index funds can lose value during market downturns. But historically, the U.S. market always recovered and reached new highs. The key is not timing the market but time in the market.

If you have at least a 5–10 year horizon, index funds are among the most stable and rewarding ways to build wealth.

Tax Benefits of Index Fund Investing in the U.S.

Another advantage is tax efficiency. Because index funds trade less frequently than actively managed funds, they generate fewer capital gains — meaning lower taxes. Also, investing through tax-advantaged accounts like a 401(k) or Roth IRA makes it even better.

- 401(k): Employer-sponsored retirement plan with tax-deferred growth.

- Roth IRA: Invest post-tax money; withdrawals in retirement are tax-free.

- Traditional IRA: Contributions may be tax-deductible; taxes apply when you withdraw.

How to Pick the Right Index Fund for You

When choosing an index fund, look at:

- Expense Ratio – Lower is better; aim for below 0.10%.

- Minimum Investment – Check if there’s a required amount to start.

- Tracking Error – How closely it matches the index’s performance.

- Reputation of the Provider – Stick with established firms like Vanguard, Fidelity, or Schwab.

Real-World Example

Let’s say you invested $10,000 in the S&P 500 index fund in 2013. As of 2023, that amount would have grown to around $32,000, even with all the ups and downs along the way. That’s nearly three times your money without constant trading or guesswork.

Final Thoughts: The Best Investment Is Simplicity

Investing doesn’t need to be complicated. Index funds make it possible for anyone in the U.S. — regardless of income or experience — to take control of their financial future. With low fees, built-in diversification, and consistent long-term growth, index funds are a quiet powerhouse in wealth building.

If you want an investment that’s simple, transparent, and proven to work over decades, index funds might just be the smartest first step you’ll ever take.

Discover more from 9Mood

Subscribe to get the latest posts sent to your email.

0 Comments