Imagine being decades away from retirement and waking up one day realizing you never set aside money to live comfortably. It’s a frightening thought — but entirely avoidable with the right plan in place. That’s where the 401(k) comes in. For millions of employees in the U.S., a 401(k) is their primary tool to build a nest egg. But despite its popularity, many people don’t fully understand how it works — how to contribute, what rules apply, and how to leverage it well. In this guide, you’ll walk through everything you need to know to feel confident managing or starting your 401(k).

1. What Is a 401(k)? (Definition + context + U.S. specificity)

A 401(k) is a tax-advantaged retirement savings account offered by many U.S. employers. It’s named after Section 401(k) of the U.S. Internal Revenue Code.

Here are the key features that make it special:

-

Employer sponsorship: It’s usually offered through your employer, not something you open yourself (though individuals open IRAs separately).

-

Pre-tax contributions (traditional 401(k)): Money you contribute is deducted from your taxable income now (you pay taxes later during withdrawal).

-

Tax-deferred growth: Earnings (interest, dividends, capital gains) grow tax-deferred until you take money out.

-

Optional Roth 401(k) variant: Some employers offer a Roth version, where contributions are after-tax but withdrawals in retirement can be tax-free (if rules are met).

-

Employer matching (often): Many employers match a portion of what you contribute, which is “free money” you don’t want to miss.

Because of those features, a 401(k) is a powerful retirement vehicle for U.S. workers.

2. How Contribution Works & Limits

To make this work, you need to understand contribution rules and limits:

a) Electing your contribution

When you join a 401(k) plan (often during your onboarding or an open enrollment period), you choose a percentage of your salary to withhold into the 401(k). For example: 5%, 10%, or more.

That amount is automatically deducted from your paycheck before (or after, if Roth) taxes, and deposited into your 401(k) account.

b) Annual limits

The IRS sets limits on how much you can contribute each year. For example, in 2023, the employee limit for people under age 50 was $22,500. If you are 50 or older, there’s a “catch-up” limit (an extra allowed contribution).

Those limits can change each year (inflation adjustments). It’s essential to check the current IRS guidelines when writing or advising.

c) Employer match & vesting

Many employers match your contributions up to a certain percentage (e.g. 50% match on first 6% of salary). For example, if you contribute 6% of your salary and your employer offers a 50% match up to 6%, they’ll contribute 3% extra. That’s free money and boosts growth.

However, some plans have vesting schedules — meaning the employer’s contributions become fully “yours” only after you remain with the company for a certain time (e.g., 2–5 years). If you leave early, some or all of the matched funds may be forfeited.

3. Investment Options & How Your Money Grows

Your 401(k) isn’t just a piggy bank — the contributions must be invested to see growth.

a) Investment choices

Typical plan options include:

-

Mutual funds (stock funds, bond funds, balanced funds)

-

Target date funds (automatically adjust risk over time)

-

Index funds

-

Sometimes company stock

The selection varies by employer and plan provider.

b) Risk, diversification, and asset allocation

You’ll want to spread your investments to balance risk and reward. Early on, you might lean heavily toward equities (raise potential growth, higher volatility). As you near retirement, you might shift toward bonds or stable assets.

Diversification helps reduce the risk that one bad investment sinks your whole account.

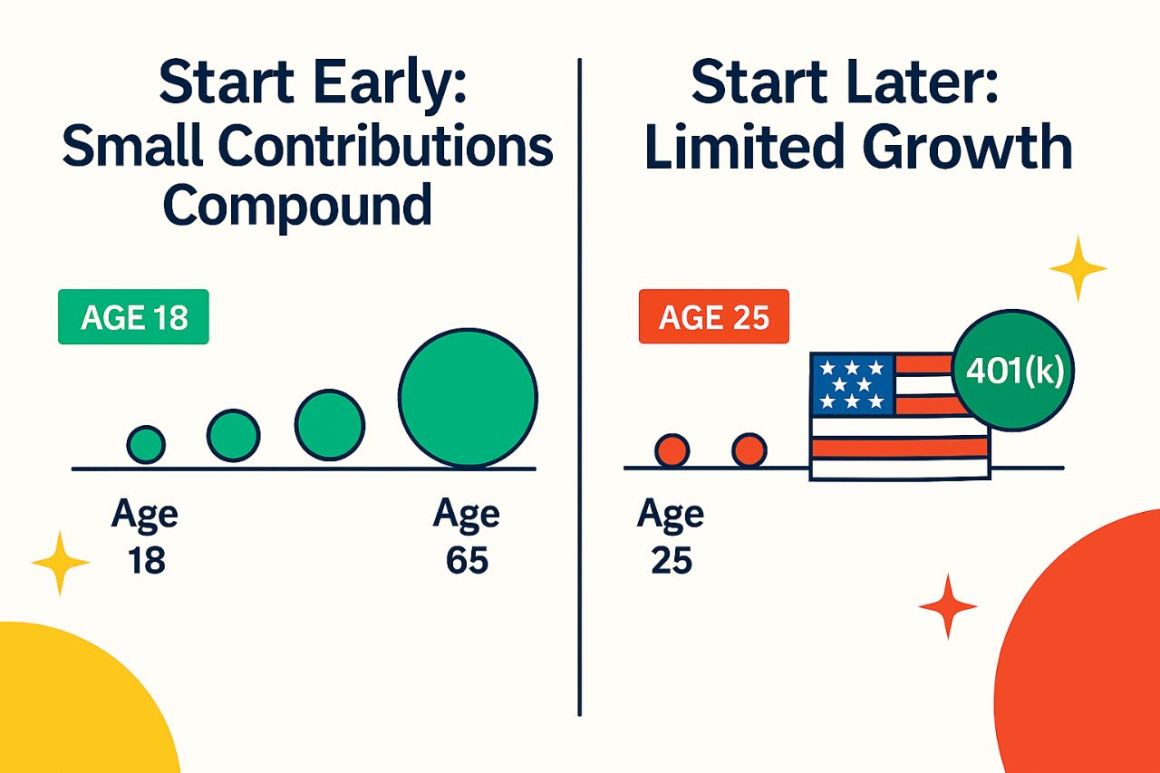

c) Compound growth over time

Because earnings (dividends, interest, capital gains) reinvest, your account compounds. The longer you stay invested, the more power compounding has. Starting early is one of the biggest advantages you’ll have.

4. Withdrawals, Taxes, and Penalties

Knowing how withdrawals work (and what penalties apply) is critical.

a) Qualified withdrawals & age rules

You can begin taking qualified distributions from your 401(k) without penalty once you reach age 59½ (for most plans). Those withdrawals are taxed as ordinary income (unless Roth, in which case they may be tax-free if conditions are met).

b) Early withdrawal penalties

If you withdraw before 59½ (with few exceptions), there is normally a 10% early withdrawal penalty plus regular income tax. Exceptions might include disability, death, or certain hardship rules (though hardship withdrawals reduce your long-term balance, so use carefully).

c) Required Minimum Distributions (RMDs)

At a certain age (currently 73, though rules can change), you must begin taking Required Minimum Distributions. Failure to do so can lead to significant tax penalties. Roth 401(k)s may be exempt from RMDs if rolled into Roth IRAs, depending on rules.

d) Rollovers & portability

If you leave your employer (resignation, layoff, etc.), you have several options:

-

Leave the money in the old plan (if allowed)

-

Roll it over to your new employer’s 401(k)

-

Roll it to an IRA (Traditional or Roth)

-

Cash out (but that often incurs taxes + penalties, so avoid unless necessary)

Rolling over allows you to maintain tax-advantaged status and continue growth.

5. Advantages & Disadvantages (Pros vs. Cons)

Advantages

-

Tax benefits (traditional: pre-tax, Roth: tax-free withdrawals)

-

Automatic saving via payroll deduction

-

Employer match (free growth)

-

Tax-deferred compounding

-

High contribution limits compared to IRAs

Disadvantages / Risks

-

Limited investment options (depends on sponsor)

-

Penalties for early withdrawal

-

Possible vesting restrictions on employer match

-

Required distributions later (RMDs)

-

Market risk: your account can lose value if markets decline

Being aware of both sides helps you use it wisely.

6. Strategy Tips to Maximize Your 401(k)

Here are practical tips that readers can use today:

-

Always contribute up to employer match at least — leaving match “on the table” is like refusing free money.

-

Start early — even modest contributions compound significantly over decades.

-

Raise contributions gradually — e.g., increase 1% each year or when you get a raise.

-

Choose low-cost funds — fees eat into returns, especially over long periods.

-

Rebalance periodically — maintain your target allocation (e.g. 60/40, 80/20) by shifting assets.

-

Diversify investments — don’t put everything in one fund or your employer’s stock.

-

Plan for withdrawals smartly — in retirement, withdraw tax-efficiently, and consider tax brackets.

-

Stay informed of IRS rules — contribution limits, RMD age, catch-up contributions change over time.

These steps help your 401(k) become a real retirement asset, not just a side account.

7. Example Scenario (to illustrate the math)

Let’s put numbers to it:

-

Suppose you earn $60,000/year.

-

You elect to contribute 6% ($3,600/year).

-

Your employer offers a 50% match on contributions up to 6%. That’s $1,800 extra.

-

So total contribution = $5,400/year.

-

Assume an average annual return of 6%.

Over 30 years, your contributions + match + compounding would grow substantially — often to hundreds of thousands.

This shows how consistent investing and employer match combine.

8. Common Misconceptions & FAQs

-

“I’ll wait until later to start contributing.” The earlier you start, the more compounding helps you.

-

“It’s too risky.” Yes, markets fluctuate, but in the long run, equities tend to rise; diversification helps.

-

“I can’t touch it until I retire.” There are some exceptions and strategies (e.g. Roth, hardship) but generally early withdrawals have penalties.

-

“My employer’s plan is bad; I’ll skip it.” Even sub-optimal plans, if matched, often outperform saving elsewhere. Use it while supplementing via IRAs.

-

“I don’t make enough.” Even small contributions matter; many plans let you contribute a fraction (1% or less) — consistency is key.

Conclusion

A 401(k) plan is one of the most effective retirement tools available to U.S. employees. With tax advantages, employer match, and compounding growth, it's a powerful vehicle for building long-term savings. But its true potential lies in how thoughtfully you use it: contribute wisely, pick smart investments, rebalance, and plan withdrawals.

If you’re not already enrolled in a 401(k) plan, check with your employer for details, decide on a contribution rate, and start early. If you are enrolled, review your investment choices and adjust to optimize returns. Over time, those incremental decisions can make a huge difference in your financial future.

Discover more from 9Mood

Subscribe to get the latest posts sent to your email.

0 Comments